Use these links to rapidly review the document

TABLE OF CONTENTS

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☑

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐

| | |

Filed by the Registrantþ |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

☐

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☑

þ |

|

Definitive Proxy Statement |

☐

o |

|

Definitive Additional Materials |

☐

o |

|

Soliciting Material under §240.14a-12

|

| | | | | |

SYNCHRONOSS TECHNOLOGIES, INC. |

(Name of Registrant as Specified In Its Charter)

| |

| | |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |

Payment of Filing Fee (Check the appropriate box):

Payment of Filing Fee (Check the appropriate box): |

þ |

☑ |

| | No fee required. | |

o |

☐ |

| | Fee paid previously with preliminary materials. | |

| | ☐ | | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.0-11 | |

TABLE OF CONTENTS

2022 NOTICE OF MEETING AND PROXY STATEMENT

| | | | | | |

|

|

(1) |

|

Title of each class of securities to which transaction applies:

|

| | Fellow Stockholders,

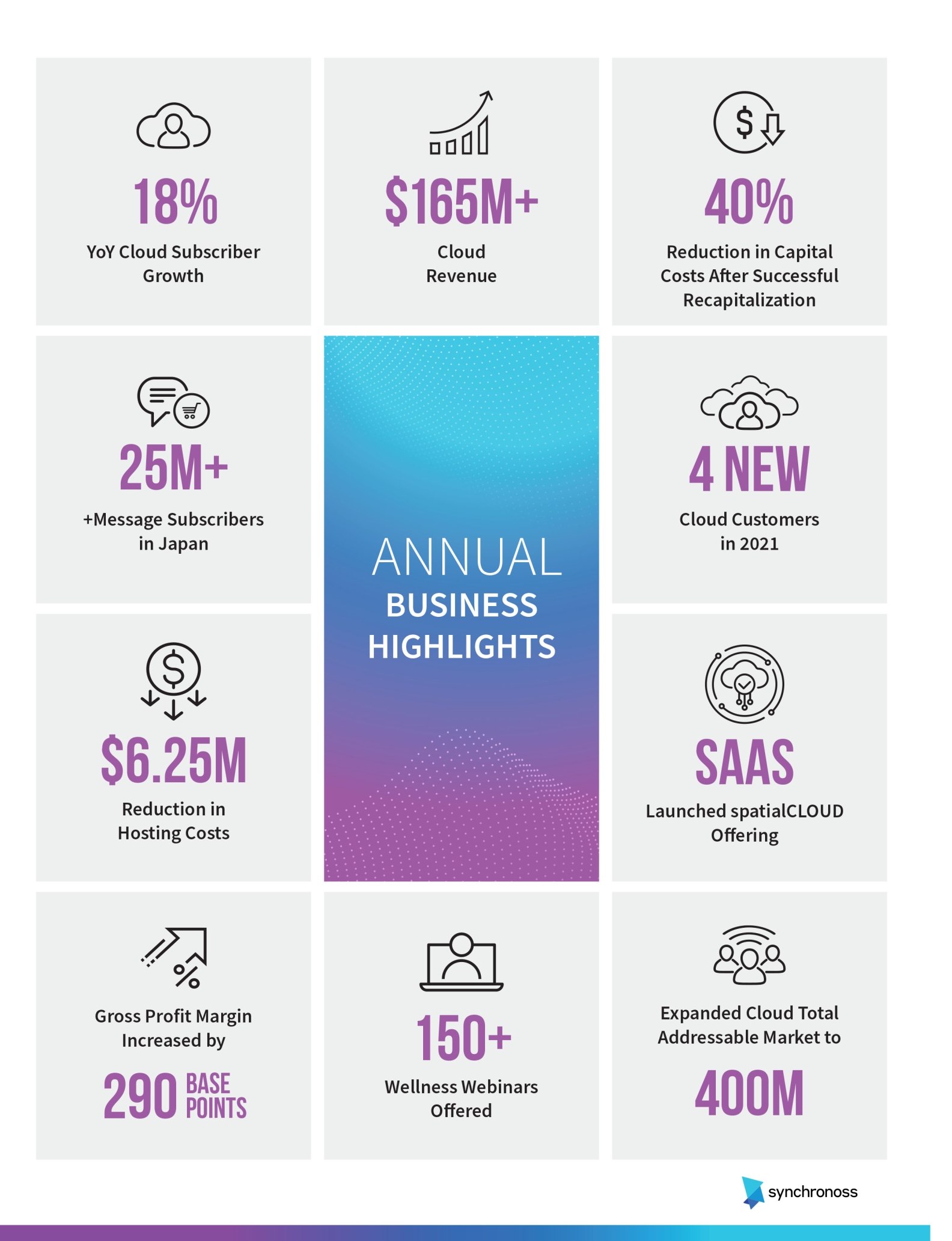

2021 tested the resolve of the global community on many levels, as nearly every sector of the world’s economy faced challenges and pressures stemming from the ongoing coronavirus (COVID-19) pandemic. Against the backdrop of inflation, disruptions to the supply chain, higher cost of goods, and an unprecedented fight for talent, the Synchronoss team remained focused on the job at hand and delivered for our customers.

Capitalizing on our two-pronged strategy of organic growth coupled with expanding our footprint in new verticals, we closed the year with a double-digit year-over-year increase in cloud subscribers. We expanded the use case of our Personal Cloud outside of the telecom industry into the retail and insurance verticals, and we welcomed new brands into the Synchronoss portfolio including our first cloud customer in Japan and two new cloud contracts in Indonesia.

In addition, our messaging team migrated millions of new subscribers onto our platforms. We also transformed our order lifecycle management iNOW platform, delivering a modern, simplified, and flexible ordering solution for our customers which broadened the product’s market appeal, reaching beyond telecom and across the geographies. We expanded our customer portfolio in our Financial Analytics, bringing in three new customers. We launched a SaaS version of our Spatial Suite solution and expanded our footprint within existing Spatial customers. We also enhanced the digital security that protects our platforms and subscriber content and completed a complex Oracle migration that we believe prepared us for the future and reduced our operating costs.

Focused on long-term profitability, we delivered on our promise to our stockholders, refinancing our capital structure and substantially lowering our total cost of capital. In doing so, we paved the way for Synchronoss to pay down debt, giving us increased flexibility and the latitude to invest for growth. In the process, we added B. Riley Financial as our new partner and largest stockholder.

Understanding that how we achieve our results is as important as what we accomplish, we took steps to further develop our ESG framework, with the goal of driving change in our communities, caring for the planet, and operating under strong principles of governance. We also continued our focus on employee wellness as a top priority, providing remote work options, global employee assistance, resources for access to vaccines, and wellness education opportunities.

In a year largely defined by social distancing, I am most proud that Synchronoss’ technology provided people, households, and communities around the globe a safe and secure place to sync, store, organize, and manage their digital memories – and stay connected.

During 2022, anchored by our values and focused on profitability, we plan to continue to streamline our business practices, narrow our scope, and hone our resources around our core product lines. | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | Sincerely, | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o | |

Fee paid previously with preliminary materials. |

o | Jeffrey G. Miller

President and Chief Executive Officer

April 28, 2022 |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

|

Dear Stockholder:TABLE OF CONTENTS

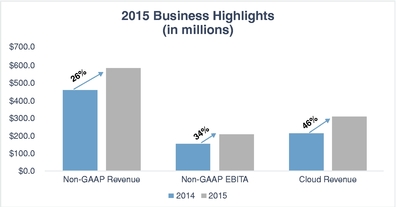

I am pleased to invite you to our 2016 Annual Meeting of Stockholders, which will be held on May 17, 2016, at 10:00 a.m. (local time), at the offices of

2022 NOTICE OF MEETING AND PROXY STATEMENT

Synchronoss Technologies, Inc.,

200 Crossing Boulevard,

Bridgewater, New Jersey.At the meeting, we will be electing two members of our Board of Directors, ratifying the appointment of Ernst & Young LLP as our independent registered public accountants for the fiscal year ending December 31, 2016, holding an advisory vote on executive compensation, and acting upon such other matters as may properly come before the meeting or any adjournments or postponements thereof.

Additional details regarding admission to the 2016 Annual Meeting and the business to be conducted are described in the accompanying proxy materials. Also included is a copy of our Annual Report on Form 10-K for 2015. We encourage you to read this information carefully.

It is important that your shares be represented and voted at the 2016 Annual Meeting. As discussed in the Proxy Statement, voting by proxy does not deprive you of your right to attend the Annual Meeting.

WHETHER OR NOT YOU PLAN TO ATTEND THE 2016 ANNUAL MEETING, WE HOPE YOU WILL VOTE AS SOON AS POSSIBLE. YOU MAY VOTE OVER THE INTERNET, BY TELEPHONE OR BY MAILING A PROXY CARD, IF YOU HAVE REQUESTED ONE. VOTING OVER THE INTERNET, BY TELEPHONE OR BY WRITTEN PROXY WILL ENSURE YOUR REPRESENTATION AT THE 2016 ANNUAL MEETING REGARDLESS OF WHETHER OR NOT YOU ATTEND IN PERSON. PLEASE REVIEW THE INSTRUCTIONS ON THE NOTICE OF INTERNET AVAILABILITY OF PROXY MATERIALS YOU RECEIVED IN THE MAIL REGARDING EACH OF THESE VOTING OPTIONS.

If you have any questions concerning the annual meeting or the proposals, please contact our Investor Relations department at (800) 575-7606. For questions regarding your stock ownership or voting, you may contact our transfer agent, American Stock Transfer & Trust Co., by e-mail through their website atwww.amstock.com or by phone at (800) 937-5449 (within the U.S. and Canada) or (718) 921-8124 (outside the U.S. and Canada).

On behalf of the Board of Directors, I would like to express our appreciation for your continued interest in the affairs of Synchronoss Technologies.

Sincerely,

Stephen G. Waldis3rd Floor

Chairman and Chief Executive Officer

April 6, 2016

The use of cameras at the Annual Meeting is prohibited and they will not be allowed into the meeting or any other related areas, except by credentialed media. We realize that many cellular phones have built-in digital cameras, and while these phones may be brought into the venue, the camera function may not be used at any time.

Table of Contents

Synchronoss Technologies, Inc.

200 Crossing Boulevard

Bridgewater, New Jersey 08807

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

OF SYNCHRONOSS TECHNOLOGIES, INC.

Notice is hereby given that Synchronoss Technologies, Inc. (the “Company”) will hold its 2022 Annual Meeting of Stockholders (the “Date: Annual MeetingMay 17, 2016

Time: 10:”) on June 16, 2022 at 11:00 a.m.

Place: Synchronoss Corporate Headquarters

200 Crossing Boulevard, Bridgewater, NJ 08807

AGENDA:

•- Eastern Time via a live interactive audio webcast on the internet. You will be able to vote and submit your questions at www.virtualshareholdermeeting.com/SNCR2022 during the meeting. We are holding the Annual Meeting for the following purposes, which are more fully described in the accompanying proxy statement:

Election of two Class I members of the Company'sCompany’s Board of Directors to serve until the 20192025 annual meeting of stockholders of the Company;

•Ratification of appointment of Ernst & Young LLP as the Company'sCompany’s independent registered public accounting firm for its fiscal year ending December 31, 2016;

•2022;Advisory vote on executive compensation;

Approving an amendment to the Company’s restated certificate of incorporation to increase the aggregate number of authorized shares (the “Authorized Share Amendment”);

Approving an increase to the number of shares issuable under the Company’s 2015 Equity Incentive Plan, conditioned upon the effectiveness of the Authorized Share Amendment (the “2015 Equity Plan Amendment”); and

•Transaction of other business that may properly come before the meeting.

Record date:You can vote if you were a stockholder of record on March 23, 2016.

A Notice of Internet Availability of Proxy Materials

("Notice"(“Notice”)

has beencontaining instructions on how to access this proxy statement for our Annual Meeting of Stockholders (the “Proxy Statement”) and our annual report for the year ended December 31, 2021 on Form 10-K (together with the Proxy Statement, the “proxy materials”) through the internet or a printed copy of the proxy materials is being mailed to stockholders of record on or about April

6, 2016. The Notice contains instructions on how to access our proxy statement for our 2016 Annual Meeting of Stockholders and our 2015 annual report to stockholders on Form 10-K (together, the "proxy materials").28, 2022. The Notice also provides instructions on how to vote online, by telephone or by mail and includes instructions on how to receive a paper copy of proxy materials by mail. The proxy materials can be accessed directly at the following

Internetinternet address:

http://materials.proxyvote.com/87157B.87157B.

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice. The stock transfer books will not be closed between the record date and the date of the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection at

Synchronoss'Synchronoss’ corporate headquarters at the address listed above for the ten-day period prior to the Annual Meeting.

Only stockholders of record at the close of business on April 18, 2022 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting as set forth in the Proxy Statement.

If you have any questions concerning the annual meeting or the proposals, please contact our Investor Relations at (949) 574-3860 or MacKenzie Partners, Inc., our proxy solicitor, at (800) 322-2885. For questions regarding your stock ownership, you may contact our transfer agent, American Stock Transfer & Trust Company LLC, by e-mail through their website at www.astfinancial.com or by phone at (800) 937-5449 (within the U.S. and Canada) or (718) 921-8124 (outside the U.S. and Canada).

By order of the Board of Directors,

Ronald J. Prague

Executive Vice President, General CounselChristina B. Gabrys

Chief Legal Officer and Corporate Secretary

April

6, 2016Important Notice Regarding the Availability of28, 2022

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD

ON JUNE 16, 2022.

The Proxy Materials for the Stockholder Meeting to be held on May 17, 2016: The proxy statementStatement and annual report to stockholders and the means to vote by Internet areis available athttp://materials.proxyvote.com/87157B.www.synchronoss.com.

WHETHER OR NOT YOU EXPECT TO ATTEND THE ANNUAL MEETING VIA THE LIVE WEBCAST, PLEASE FOLLOW THE INTERNET VOTING INSTRUCTIONS ON YOUR NOTICE OR PROXY CARD TO ASSURE REPRESENTATION OF YOUR SHARES.

TABLE OF CONTENTS

The table below reflects the potential payments and benefits to which the named executive officersMessrs. Miller, Greenwald, Hill, Doran and Ferraro would be entitled pursuant to their respective employment agreements.agreements if such executive officer’s employment was terminated effective as of December 31, 2021. There are no agreements, arrangements or plans that entitle executive officers to severance, perquisites, or other enhanced benefits in connection with the termination of their employment other than the employment agreements. agreements and executive employment plan.

| | Jeffrey Miller | | | Severance(1) | | | 0 | | | 1,267,823 | | | 500,000 | | | 2,030,646 | |

| | | | | Option Acceleration(2) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | Restricted Stock Acceleration(3) | | | 0 | | | 0 | | | 480,456 | | | 4,105,037 | |

| | | | | Benefit Continuation(4) | | | 0 | | | 32,975 | | | 32,975 | | | 32,975 | |

| | | | | Total Value | | | 0 | | | 1,300,798 | | | 1,013,431 | | | 6,168,658 | |

| | Taylor Greenwald | | | Severance(1) | | | 0 | | | 858,000 | | | 45,500 | | | 1,560,000 | |

| | | | | Option Acceleration(2) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | Restricted Stock Acceleration(3) | | | 0 | | | 0 | | | 878,400 | | | 878,400 | |

| | | | | Benefit Continuation(4) | | | 0 | | | 7,393 | | | 7,393 | | | 7,393 | |

| | | | | Total Value | | | 0 | | | 865,393 | | | 931,293 | | | 2,445,793 | |

| | Christopher Hill | | | Severance(1) | | | 0 | | | 913,628 | | | 357,291 | | | 1,218,171 | |

| | | | | Option Acceleration(2) | | | 0 | | | 0 | | | 6,333 | | | 6,333 | |

| | | | | Restricted Stock Acceleration(3) | | | 0 | | | 0 | | | 183,278 | | | 932,724 | |

| | | | | Benefit Continuation(5) | | | 0 | | | 16,509 | | | 33,017 | | | 24,763 | |

| | | | | Total Value | | | 0 | | | 930,137 | | | 579,919 | | | 2,181,991 | |

| | Patrick Doran | | | Severance(1) | | | 0 | | | 772,248 | | | 255,191 | | | 1,029,664 | |

| | | | | Option Acceleration(2) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | Restricted Stock Acceleration(3) | | | 0 | | | 0 | | | 200,897 | | | 1,249,218 | |

| | | | | Benefit Continuation(5) | | | 0 | | | 25,027 | | | 50,055 | | | 37,541 | |

| | | | | Total Value | | | 0 | | | 797,275 | | | 506,143 | | | 2,316,423 | |

| | Louis Ferraro | | | Severance(1) | | | 0 | | | 623,817 | | | 152,594 | | | 831,756 | |

| | | | | Option Acceleration(2) | | | 0 | | | 0 | | | 0 | | | 0 | |

| | | | | Restricted Stock Acceleration(3) | | | 0 | | | 0 | | | 83,416 | | | 412,667 | |

| | | | | Benefit Continuation(5) | | | 0 | | | 27,816 | | | 55,637 | | | 41,728 | |

| | | | | Total Value | | | 0 | | | 651,633 | | | 291,647 | | | 1,286,151 | |

(1)

| For purposes of valuing cash severance payments in the table above, we used each NEO’s base salary as of December 31, 2021. For purposes of calculating cash severance payments in the table above in the event of an involuntary termination (whether prior to, within 24 months following, or more than 24 months following, a change in control), we used each NEO’s average annual bonuses for 2020 and 2021 and, for purposes of calculating cash severance payments in the table above in the event of a termination due to permanent disability, we used the NEO’s target bonus as of December 31, 2021. |

(2)

| The value of option acceleration shown in the table above was calculated based on the assumption that the triggering event occurred on December 31, 2021. The value of the vesting acceleration was calculated by multiplying the number of unvested shares subject to each option by the excess of the closing price of our Common Stock on December 31, 2021, the last trading day of the year, over the exercise price of the option. |

(3)

| The value of restricted stock acceleration shown in the table above was calculated based on the assumption that the triggering event occurred on December 31, 2021. The value of the vesting acceleration was calculated by multiplying the number of unvested shares subject to each restricted stock grant by the closing price of our Common Stock on December 31, 2021, the last trading day of the year. |

Synchronoss Technologies 55

TABLE OF CONTENTS

(4)

| Amounts reflect 24x the current monthly costs to us of the individual’s health and welfare benefits per year for Termination without change in control, Death or Disability or Termination due to change in control. |

(5)

| Amounts reflect 12x the current monthly costs to us of the individual’s health and welfare benefits per year for Involuntary Termination without change in control; 24x the current costs to us of the individual’s health and welfare benefits per year for Death or Disability; 18x the current costs to us of the individual’s health and welfare benefits per year for Termination due to change in control. |

The amounts shownfollowing table describes the actual payment and benefits provided to Mr. Prague and Mr. Clark upon their departure from their employment with our Company effective September 2, 2021 and August 9, 2021, respectively.

| | Ronald Prague | | | Severance | | | $728,065 | |

| | | | | Benefit Continuation | | | $51,722 | |

| | | | | Total Value | | | $779,787 | |

| | David Clark | | | Severance | | | $746,185 | |

| | | | | Benefit Continuation | | | $51,722 | |

| | | | | Total Value | | | $797,907 | |

Pay Ratio Disclosure

As required by the Dodd-Frank Act and applicable SEC rules, we are providing the following information about the relationship of the annual total compensation of our employees and the annual total compensation of Jeffrey Miller our Chief Executive Officer:

For our fiscal year ended December 31, 2021:

The median of the annual total compensation of all employees (other than our CEO) was $57,438; and

The annual total compensation of our CEO, as reported in the table below assume that each termination2021 Summary Compensation Table included elsewhere in this Proxy Statement, was effective$4,647,924.

Based on this information the ratio of the annual total compensation of our CEO to the median of the annual total compensation of our employees was 80.9 to 1.

The above ratio is appropriately viewed as an estimate. To identify the median of the annual compensation of our employees, we reviewed the current base salary and the bonus and long-term incentive compensation targets of our U.S. and non-U.S. employees as of December 31,

2015. | | | | | | | | | | | | | | | |

Name | | Benefit | | Voluntary

Resignation/

Termination

for Cause($) | | Involuntary

Termination

Prior to, or More

Than 24 Months

after, a Change

in Control($) | | Termination

Due to

Death or

Disability($) | | Involuntary

Termination

Within 24 Months

After a Change

in Control($) | |

|---|

| Stephen G. Waldis | | Severance(1) | | | -0- | | | 2,964,907 | | | 650,282 | | | 3,550,160 | |

| | | Option Acceleration(2) | | | -0- | | | -0- | | | -0- | | | 227,806 | |

| | | Restricted Stock Acceleration(3) | | | -0- | | | -0- | | | -0- | | | 4,074,631 | |

| | | Accrued Vacation(4) | | | 11,369 | | | 11,369 | | | 11,369 | | | 11,369 | |

| | | Benefit Continuation(5) | | | -0- | | | 25,505 | | | 25,505 | (6) | | 25,505 | |

| | | | | | | | | | | | | | | | |

| | | Total Value | | $ | 11,369 | | $ | 3,001,781 | | $ | 687,155 | | $ | 7,889,471 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Karen L. Rosenberger | | Severance(1) | | | -0- | | | 745,580 | | | 198,000 | | | 1,161,159 | |

| | | Option Acceleration(2) | | | -0- | | | -0- | | | -0- | | | 13,771 | |

| | | Restricted Stock Acceleration(3) | | | -0- | | | -0- | | | -0- | | | 985,771 | |

| | | Accrued Vacation(4) | | | 6,346 | | | 6,346 | | | 6,346 | | | 6,346 | |

| | | Benefit Continuation(5) | | | -0- | | | 25,505 | | | 25,505 | (6) | | 25,505 | |

| | | | | | | | | | | | | | | | |

| | | Total Value | | $ | 6,346 | | | 777,431 | | $ | 229,851 | | $ | 2,192,552 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Robert E. Garcia | | Severance(1) | | | -0- | | | 1,125,546 | | | 349,673 | | | 1,814,001 | |

| | | Option Acceleration(2) | | | -0- | | | -0- | | | -0- | | | 136,629 | |

| | | Restricted Stock Acceleration(3) | | | -0- | | | -0- | | | -0- | | | 2,657,258 | |

| | | Accrued Vacation(4) | | | 8,406 | | | 8,406 | | | 8,406 | | | 8,406 | |

| | | Benefit Continuation(5) | | | -0- | | | 25,505 | | | 25,505 | (6) | | 25,505 | |

| | | | | | | | | | | | | | | | |

| | | Total Value | | $ | 8,406 | | $ | 1,159,457 | | $ | 383,584 | | $ | 4,641,799 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| Daniel Rizer | | Severance(1) | | | -0- | | | 928,825 | | | 231,472 | | | 1,471,865 | |

| | | Option Acceleration(2) | | | -0- | | | -0- | | | -0- | | | 34,904 | |

| | | Restricted Stock Acceleration(3) | | | -0- | | | -0- | | | -0- | | | 1,297,133 | |

| | | Accrued Vacation(4) | | | 7,419 | | | 7,419 | | | 7,419 | | | 7,419 | |

| | | Benefit Continuation(5) | | | -0- | | | 20,627 | | | 20,627 | (6) | | 20,627 | |

| | | | | | | | | | | | | | | | |

| | | Total Value | | $ | 7,419 | | | 956,871 | | $ | 259,518 | | $ | 2,831,948 | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | |

| David Schuette | | Severance(1) | | | -0- | | | 525,000 | | | 146,666 | | | 866,666 | |

| | | Option Acceleration(2) | | | -0- | | | -0- | | | -0- | | | -0- | |

| | | Restricted Stock Acceleration(3) | | | -0- | | | -0- | | | -0- | | | 1,939,024 | |

| | | Accrued Vacation(4) | | | 3,526 | | | 3,526 | | | 3,526 | | | 3,526 | |

| | | Benefit Continuation(5) | | | -0- | | | 24,169 | | | 24,169 | (6) | | 24,169 | |

| | | | | | | | | | | | | | | | |

| | | Total Value | | $ | 3,526 | | $ | 552,694 | | $ | 174,361 | | $ | 2,833,384 | |

(1)For2021. Out of our approximately 1,528 employees, approximately 755 of our employees are located in India. Once we identified our “median employee,” using the methodology described above, we determined that employee’s annual total compensation in accordance with the requirements of Item 402(c)(2)(x) of Regulation S-K for purposes of valuing cash severance payments incalculating the table above, we used each executive officer's base salary and target bonus as of December 31, 2015.

(2)The value of option acceleration shown in the table above was calculated based on the assumption that the triggering event occurred on December 31, 2015. The value of the vesting acceleration was calculated by multiplying the number of unvested shares subject to each option by the excess of the closing price of our Common Stock on December 31, 2015, over the exercise price of the option.

(3)The value of restricted stock acceleration shown in the table above was calculated based on the assumption that the triggering event occurred on December 31, 2015. The value of the vesting acceleration was calculated by multiplying the number of unvested shares subject to each restricted stock grant by the closing price of our Common Stock on December 31, 2015.

(4)Based on each executive officer's base salary in effect and the number of accrued but unused vacation days as of December 31, 2015.

(5)Amounts reflect two times the current cost to us of the individual's health and welfare benefits per year.

(6)Only payable in the event of a disability.

required pay ratio. 56 Synchronoss Technologies

Table of ContentsTABLE OF CONTENTS

Report of the Audit

Committee(1)Committee(1)

The Audit Committee of the Board consists of the three non-employee directors named below. The Board annually reviews the Nasdaq listing

standards'standards’ definition of independence for audit committee members and has determined that each member of the Audit Committee meets that standard. The Board has also determined that

each of Donnie M. Moore and Thomas HopkinsLaurie Harris is an audit committee financial expert as described in applicable rules and regulations of the Securities and Exchange Commission.

The principal purpose of the Audit Committee is to assist the Board in its general oversight of the

Company'sCompany’s accounting and financial reporting processes and audits of the

Company'sCompany’s financial statements. The Audit Committee is responsible for selecting and engaging the

Company'sCompany’s independent registered public accounting firm and approving the audit and non-audit services to be provided by the independent registered public accounting firm. The Audit

Committee'sCommittee’s function is more fully described in its

Charter,charter, which the Board has adopted and which the Audit Committee reviews on an annual basis.

The

Company'sCompany’s management is responsible for preparing the

Company'sCompany’s financial statements and the

Company'sCompany’s financial reporting process. Ernst & Young LLP, the

Company'sCompany’s independent registered public accounting firm, is responsible for performing an independent audit of the

Company'sCompany’s consolidated financial statements and expressing an opinion on the conformity of those financial statements with U.S. generally accepted accounting principles. The Audit Committee has reviewed and discussed with the

Company'sCompany’s management the audited financial statements of the Company included in the

Company'sCompany’s Annual Report on Form 10-K for the fiscal year ended December 31,

20152021 (the

"10-K"“10-K”).

The Audit Committee has also reviewed and discussed with Ernst & Young LLP the audited financial statements in the 10-K. In addition, the Audit Committee discussed with Ernst & Young LLP those matters required to be discussed by

the applicable requirements of the Public Company Accounting Oversight Board and the Securities and Exchange Commission. Statement on Auditing Standards No. 61, as amended or supplemented, entitled

"Communications“Communications with Audit Committees.

"” Additionally, Ernst & Young LLP provided to the Audit Committee the written disclosures and the letter required by

Rule 3526the applicable requirements of the Public Company Accounting Oversight

Board (Communications with Audit Committees Concerning Independence).Board. The Audit Committee also discussed with Ernst & Young LLP its independence from the Company.

Based upon the review and discussions described above, the Audit Committee recommended to our Board of Directors that the audited financial statements be included in the 10-K for filing with the United States Securities and Exchange Commission.

Submitted by the following members of the Audit Committee:

Donnie M. Moore, Chairman

Laurie L. Harris, Chair

William J. Cadogan

Kristin S. RinneThomas J. Hopkins

(1)The material in this report is not "soliciting material," is not deemed "filed"

Martin F. Bernstein

Synchronoss Technologies

Inc. under the Securities Act or the Exchange Act, whether made before or after the date hereof and irrespective of any general incorporation language in any such filing.57

TABLE OF CONTENTS

Table of Contents

Equity Security Ownership of Certain Beneficial Owners and Management

The following table sets forth certain information as of April 6, 2016 with respectknown to theus regarding beneficial ownership of our Common Stock byas of April 18, 2022 by:

each person, or group of affiliated persons, who is known to us to own beneficially more than 5%five percent (5%) of our Common Stock, Stock;

each of our directors,named executive officers;

each of our NEOs,current directors; and

all of our

current directors and executive officers

and directors as a group.

We have no other class of equity securities outstanding.The table below is based upon information supplied by executive officers, directors and principal stockholders and Schedule 13Gs and 13Ds filed with the SEC through April 18, 2022.

As of

March 23, 2016, 45,204,451April 18, 2022, 88,259,403 shares of our Common Stock were outstanding. The amounts and percentages of our Common Stock beneficially owned are reported on the basis of regulations of the

Securities and Exchange Commission ("SEC")SEC governing the determination of beneficial ownership of securities.

The information does not necessarily indicate beneficial ownership for any other purposes. Under the SEC rules, a person is deemed to be a

"beneficial owner"“beneficial owner” of a security if that person has or shares

"voting“voting power,

"” which includes the power to vote or direct the voting of such security, or

"investment“investment power,

"” which includes the power to dispose of or to direct the disposition of such security. A person is also deemed to be a beneficial owner of any securities of which that person has a right to acquire beneficial ownership within 60 days. Under these rules, more than one person may be deemed a beneficial owner of securities as to which such person has no economic interest.

| | | | | | | | | |

| | | | | | | | | | |

| | Name of Beneficial Owner (*)

|

|

| Beneficially

Owned (1) |

| Percent

(2) |

| |

| | | | | | | | | | |

| | Stephen G. Waldis | | | 935,101 | (3) | 2.0% | | |

| | | | | | | | | | |

| | James M. McCormick | | | 3,125,561 | (4) | 6.9% | | |

| | | | | | | | | | |

| | William J. Cadogan | | | 344,852 | (5) | ** | | |

| | | | | | | | | | |

| | Charlie E. Hoffman | | | 85,378 | (6) | ** | | |

| | | | | | | | | | |

| | Thomas J. Hopkins | | | 84,678 | (7) | ** | | |

| | | | | | | | | | |

| | Donnie M. Moore | | | 96,092 | (8) | ** | | |

| | | | | | | | | | |

| | Karen L Rosenberger | | | 45,280 | (9) | ** | | |

| | | | | | | | | | |

| | Robert E. Garcia | | | 131,109 | (10) | ** | | |

| | | | | | | | | | |

| | Daniel Rizer | | | 49,115 | (11) | ** | | |

| | | | | | | | | | |

| | David Schuette | | | 55,039 | (12) | ** | | |

| | | | | | | | | | |

| | All executive officers and directors as a group (15 persons) | | | 5,114,473 | (13) | 11.0% | | |

| | | | | | | | | | |

| | FMR LLC, 82 Devonshire Street, Boston, MA 02109 | | | 3,280,157 | (14) | 7.3% | | |

| | | | | | | | | | |

| | Blackrock, Inc., 40 East 52nd Street, New York, NY 10022 | | | 3,832,174 | (15) | 8.5% | | |

| | | | | | | | | | |

| | Oak Ridge Investments LLC, 10 S. LaSalle St., Chicago, IL 60603 | | | 2,554,166 | (16) | 5.7% | | |

| | | | | | | | | | |

| | RBC Global Asset Management (US) Inc.,

50 So. Sixth St., Minneapolis, MN 55402 |

| | 2,616,977 | (17) | 5.8% | | |

| | | | | | | | | | |

| | The Vanguard Group, 100 Vanguard Blvd., Malvern, PA 19355 | | | 2,887,460 | (18) | 6.4% | | |

| | | | | | | | | | |

*Unless Except as otherwise indicated,set forth below, the street address of eachthe beneficial owner is c/o Synchronoss Technologies, Inc., 200 Crossing Boulevard, Bridgewater, NJ 08807.

| | B. Riley Financial, Inc.(2) | | | 12,595,181 | | | 14.3 | |

| | 180 Degree Capital Corp.(3) | | | 6,206,236 | | | 7.0 | |

| | Directors, Current Executive Officers and

Named Executive Officers | | | | | | | |

| | Stephen Waldis(4) | | | 657,290 | | | * | |

| | Jeffrey Miller(5) | | | 582,210 | | | * | |

| | Taylor Greenwald(6) | | | 460,000 | | | * | |

| | Christopher Hill(7) | | | 266,572 | | | * | |

| | Patrick Doran(8) | | | 449,028 | | | * | |

| | Louis Ferraro Jr.(9) | | | 103,443 | | | * | |

| | Kristin Rinne(10) | | | 141,847 | | | * | |

| | Mohan Gyani(11) | | | 92,531 | | | * | |

| | Laurie Harris(12) | | | 122,531 | | | * | |

| | Martin Bernstein(13) | | | 0 | | | * | |

| | All current executive officers and directors as a group

(11 persons)(14) | | | 2,898,478 | | | 3.3 | |

(1)

| Does not include 75,000 shares of Series B Preferred Stock, which are non-voting and non-convertible. |

(2)

| B. Riley Financial, Inc. beneficially owns 11,671,579 shares of Common Stock, with shared voting power with respect to 11,671,579 of such shares and shared dispositive power with respect to 11,671,579 of such shares. Bryant R. Riley beneficially owns 12,595,181 shares of Common Stock, with sole voting power with respect to 923,602 of such shares, sole dispositive power with respect to 923,602 of such shares, with shared voting power with respect to 11,671,759 of such shares and shared dispositive power with respect to 11,671,579 of such shares. Bryant R. Riley may be |

58 Synchronoss Technologies

**Less than 1% of theTABLE OF CONTENTS

deemed to indirectly beneficially own 923,602 shares of Common Stock, outstandingof which (i) 913,774 shares received upon distribution from a limited partnership are held jointly with his wife, Carleen Riley, (ii) 2,457 shares received upon distribution from a limited partnership are held as of March 23, 2016.

(1)Represents sum of shares owned and shares which may be purchased upon exercise of options exercisable within 60 days of March 23, 2016.

(2)Any shares not outstanding which are subject to options exercisable within 60 days of March 23, 2016 are deemed outstandingsole custodian for the purposebenefit of computing the percentage of outstandingAbigail Riley, (iii) 2,457 shares owned by any

Table of Contents

person holding such shares butreceived upon distribution from a limited partnership are not deemed outstandingheld as sole custodian for the purposebenefit of computingCharlie Riley, (iv) 2,457 shares received upon distribution from a limited partnership are held as sole custodian for the percentagebenefit of Eloise Riley and (iv) 2,457 shares owned by any other person.

(3)Includes 101,845received upon distribution from a limited partnership are held as sole custodian for the benefit of Susan Riley. Bryant R. Riley may also be deemed to indirectly beneficially own the 11,671,579 shares of restricted common stock subject toCommon Stock held directly by B. Riley Financial, Inc. Bryant R. Riley disclaims beneficial ownership of the Company's lapsing right of repurchase. Includes 498,259 shares subject to options exercisable within 60 days of March 23, 2016. Excludes 187,400 shares subject to options not exercisable within 60 days of March 23, 2016.

(4)Includes 870,000 shares held by Vertek Corporation,B. Riley Financial, Inc. in each case except to the extent of which Mr. McCormickhis pecuniary interest therein. The address for B. Riley Financial and Bryant R. Riley is the Chief Executive Officers111000 Santa Monica Boulevard, Suite 800, Los Angeles, CA 90025. The foregoing information is based on a Schedule 13D filed by B. Riley Financial, Inc. and sole stockholder. Mr. McCormick exercises sole voting and dispositive power with respect to such shares. Includes 6,670Bryant R. Riley on March 11, 2022.

(3)

| 180 Degree Capital Corp. beneficially owns 6,206,236 shares of Common Stock, with shared voting power with respect to 6,206,236 of such shares and shared dispositive power with respect to 6,206,236 of such shares. 180 Degree Capital Corp. disclaims beneficial ownership of 2,123,658 of these shares that are beneficially owned by a separately managed account (“SMA”). 180 Degree Capital Corp. has shared dispositive and voting power over these shares through its position as Investment Manager of the SMA. 180 Degree Capital Corp. disclaims beneficial ownership of these shares owned by SMA except for its pecuniary interest therein. The address for 180 Degree Capital Corp. is 7 N. Willow Street, Suite 4B, Montclair, New Jersey 07042. The foregoing information is based on a Schedule 13G filed by 180 Degree Capital Corp. on February 14, 2022. |

(4)

| Includes 50,458 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 61,399 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 19,766 shares subject to options not exercisable within 60 days of April 18, 2022. |

(5)

| Includes 123,947 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 206,110 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 195,811 shares subject to options not exercisable within 60 days of April 18, 2022. |

(6)

| Includes 360,000 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Excludes 206,711 shares subject to options not exercisable within 60 days of April 18, 2022. |

(7)

| Includes 68,469 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 37,307 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 99,163 shares subject to options not exercisable within 60 days of April 18, 2022. |

(8)

| Includes 67,568 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 162,176 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 67,838 shares subject to options not exercisable within 60 days of April 18, 2022. |

(9)

| Includes 29,730 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 32,005 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 71,726 shares subject to options not exercisable within 60 days of April 18, 2022. |

(10)

| Includes 33,639 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 63,833 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 13,177 shares subject to options not exercisable within 60 days of April 18, 2022. |

(11)

| Includes 33,639 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 47,106 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 13,177 shares subject to options not exercisable within 60 days of April 18, 2022. |

(12)

| Includes 33,639 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 37,106 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 23,177 shares subject to options not exercisable within 60 days of April 18, 2022. |

(13)

| Excludes 30,000 shares subject to options not exercisable within 60 days of April 18, 2022. |

(14)

| Includes 810,343 shares of restricted common stock subject to the Company’s lapsing right of repurchase. Includes 654,467 shares subject to options exercisable within 60 days of April 18, 2022. Excludes 799,823 shares subject to options not exercisable within 60 days of April 18, 2022. |

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Exchange Act requires the Company’s directors and executive officers, and persons who own more than ten percent of a registered class of the Company’s equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of common stock subjectand other equity securities of the Company. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish the Company with copies of all Section 16(a) forms they file.

To the Company’s knowledge, based solely on a review of the copies of such reports furnished to the Company's lapsing right of repurchase. Includes 75,000 shares subjectCompany during the fiscal year ended December 31, 2021, all Section 16(a) filing requirements applicable to options exercisable within 60 days of March 23, 2016. Excludes 15,000 shares subjectits officers, directors and greater than ten percent beneficial owners were complied with, except that one Form 4 for Louis Ferraro was late on August 12, 2021 due to options not exercisable within 60 days of March 23, 2016.

(5)Includes 6,670 shares of restricted common stock subjecta delay in obtaining Edgar codes upon him being named an officer and one Form 4 for Taylor Greenwald was late on November 10, 2021 due to the Company's lapsing right of repurchase. Includes 50,000 shares held by Barbara Cadogan, Mr. Cadogan's wife. Includes 85,000 shares subject to options exercisable within 60 days of March 23, 2016. Excludes 15,000 shares subject to options not exercisable within 60 days of March 23, 2016.

(6)Includes 6,670 shares of restricted common stock subject to the Company's lapsing right of repurchase. Includes 75,000 shares subject to options exercisable within 60 days of March 23, 2015. Excludes 15,000 shares subject to options not exercisable within 60 days of March 23, 2016.

(7)Includes 6,670 shares of restricted common stock subject to the Company's lapsing right of repurchase. Includes 85,000 shares subject to options exercisable within 60 days of March 23, 2016. Excludes 15,000 shares subject to options not exercisable within 60 days of March 23, 2016.

(8)Includes 6,670 shares of restricted common stock subject to the Company's lapsing right of repurchase. Includes 70,000 shares subject to options exercisable within 60 days of March 23, 2016. Excludes 15,000 shares subject to options not exercisable within 60 days of March 23, 2016.

(9)Includes 28,425 shares of restricted common stock subject to the Company's lapsing right of repurchase. Includes 4,106 shares subject to options exercisable within 60 days of March 23, 2016. Excludes 29,219 shares subject to options not exercisable within 60 days of March 23, 2016.

(10)Includes 31,568 shares of restricted common stock subject to the Company's lapsing right of repurchase. Includes 115,209 shares subject to options exercisable within 60 days of March 23, 2016. Excludes 115,304 shares subject to options not exercisable within 60 days of March 23, 2016.

(11)Includes 42,487 shares of restricted common stock subject to the Company's lapsing right of repurchase. Includes 17,500 shares subject to options exercisable within 60 days of March 23, 2016. Excludes 56,082 shares subject to options not exercisable within 60 days of March 23, 2016.

(12)Includes 14,771 shares of restricted common stock subject to the Company's lapsing right of repurchase. Includes 14,561 shares subject to options exercisable within 60 days of March 16, 2015. Excludes 26,461 shares subject to options not exercisable within 60 days of March 16, 2015.

(13)Includes 373,091 shares of restricted common stock subject to the Company's lapsing right of repurchase. Includes 1,162,994 shares subject to options exercisable within 60 days of March 23, 2016. Excludes 617,805 shares subject to options not exercisable within 60 days of March 16, 2015.

(14)Information on the holdings of FMR LLC includes the holdings of Fidelity Management & Research Company ("Fidelity Management"), and is taken from its Schedule 13G filed on January 11, 2016. Edward C. Johnson 3d and FMR LLC, through its control of Fidelity Management, have sole power to dispose of the shares. Members of the family of Edward C. Johnson 3d, Chairman of FMR LLC, are the predominant owners, directly or through trusts, of Series B voting common shares of FMR LLC, representing 49% of the voting power of FMR LLC. The Johnson family group and all other Series B stockholders have entered into a stockholders' voting agreement under which all Series B voting common shares will be voteddelay in accordance with the majority vote of Series B voting common shares. Accordingly, through their ownership of votingobtaining Edgar codes upon him being named an officer.

Table of Contents

common shares and the execution of the stockholders' voting agreement, members of the Johnson family may be deemed, under the Investment Company Act of 1940, to form a controlling group with respect to FMR LLC. Neither FMR LLC nor Edward C. Johnson 3d, Chairman of FMR LLC, has the sole power to vote or direct the voting of the shares owned directly by the Fidelity Funds, which power resides with the Funds' Boards of Trustees. Fidelity carries out the voting of the shares under written guidelines established by the Funds' Boards of Trustees.

(15)Information on the holdings of BlackRock, Inc. includes the holdings of BlackRock Institutional Trust Company, N.A., BlackRock Fund Advisors, BlackRock Asset Management Canada Limited, BlackRock Asset Management (Australia) Limited, BlackRock Advisors, LLC, BlackRock Asset Management Ireland Limited, BlackRock Investment Management, LLC, BlackRock Advisors (UK) Limited, BlackRock Investment Management (UK) Limited and BlackRock International Limited, and is taken from its Schedule 13G filed on January 27, 2016.

(16)Information on the holdings of Oak Ridge Investments LLC is taken from its Schedule 13G filed on February 8, 2016.

(17)Information on RBC Global asset Management (US) Inc. is taken from its Schedule 13G filed on February 10, 2016.

(18)Information on the holdings of The Vanguard Group is taken from its Schedule 13G filed on February 10, 2016. Vanguard Fiduciary Trust Company, a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 83,377 shares of our Common Stock as a result of its serving as investment manager of collective trust accounts. Vanguard Investments Australia, Ltd., a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 4,400 shares of our Common Stock as a result of its serving as investment manager of Australian investment offerings.

Certain Related Party Transactions

Transactions, arrangements or relationships in which we were, are or will be a participant and the amount involved exceeds $120,000, and in which any related person had, has or will have a direct or indirect material interest are subject to review, approval or ratification by our Board or a committee composed of members of our Board. Our Audit Committee has the principal responsibility for reviewing related person transactions pursuant to written policies and procedures adopted by our Board, subject to specified exceptions and other than those that involve compensation. In conformance with regulations of the SEC, these policies and procedures define related persons to include our executive officers, our directors and nominees to become a director of our Company, any person who is

Synchronoss Technologies 59

TABLE OF CONTENTS

known to us to be the beneficial owner of more than 5% of any class of our voting securities, any immediate family member of, or person sharing the household with, any of the foregoing persons, and any firm, corporation or other entity in which any of the foregoing persons is employed, is a general partner or in which such person has a 5% or greater beneficial ownership interest.

As set forth inIn accordance with our policies and procedures,

it is our general policy that related person transactions shall be consummated or shall continue only if approved or ratified by our Audit Committee or the disinterested members of our Board and only if the terms of the transaction are determined to be in, or not to be inconsistent with, the best interests of our Company and our stockholders. The approval of our Compensation Committee is required to approve any transaction that involves compensation to our directors and executive officers. This approval process does not apply to any transaction that is available to all of our employees generally.

During 2015, we engaged Meeker Sharkey

Redemption of the Series A Preferred Stock

The net proceeds from the Common Stock offering, Senior Note offering and Series B Transaction (all as our insurance broker for our officersdefined below) were used in part to fully redeem all outstanding shares of Synchronoss Series A Convertible Participating Perpetual Preferred Stock on June 30, 2021.

Underwritten Offering of Common Stock

On June 24, 2021, Synchronoss completed an underwritten offering of its common stock in which B. Riley Securities, Inc. (“BRS”) acted as representative of the underwriters. In connection with the offering, BRS and

directors, commercial liabilitythe other underwriters in the offering were entitled to an underwriting discount of approximately $6.1 million and

health benefits insurance. Thomas Sharkey, Jr., a principalreimbursement of

Meeker Sharkey, is the brother in lawcertain out-of-pocket expenses incurred of

James M. McCormick, a member of our Board. During 2015, we paid Meeker

Table of Contents

Sharkey $452,524. In addition to any value received by Mr. Sharkey, Jr. by virtue of his minority ownership interest in Meeker Sharkey, he received a commission from Meeker Sharkeyapproximately $0.1 million in connection with our insurance policies. Our Audit Committee approved our engagementthe offering.

June 2021 Underwritten Offering of Meeker SharkeySenior Notes

On June 25, 2021, Synchronoss completed an underwritten offering of its 8.375% senior notes due 2026 (the “Senior Notes”) in which BRS acted as our insurance brokerrepresentative of the underwriters. In connection with the offering, BRS and the other underwriters in the offering were entitled to an underwriting discount of approximately $4.2 million and reimbursement of certain out-of-pocket expenses incurred of approximately $0.1 million.

October 2021 At Market Offering of Senior Notes

On October 25, 2021, Synchronoss entered into an At Market Issuance Sales Agreement between Synchronoss and BRS, as agent, pursuant to which Synchronoss may offer and sell, from time to time, up to $18 million of the Senior Notes. In connection with the offering, BRS is entitled to compensation of 2.0% of the gross proceeds of all notes sold through it as Synchronoss’ agent.

Sale of Series B Preferred Stock

On June 30, 2021, pursuant to a related party transaction. During 2015,Series B Stock Purchase Agreement dated June 24, 2021 between B. Riley Principal Investments, LLC and Synchronoss, we acquired certain contract rights from Slide 3 Advisors, LLC for approximately $1.2 million. David Schuette, onesold 75,000 shares of our NEOs wasSeries B Perpetual Non-Convertible Preferred Stock, par value $0.0001 per share, with an initial liquidation preference of $1,000 per share (the “Series B Preferred Stock”), for an aggregate purchase price of $75,000,000 (the “Preferred Transaction”) to B. Riley Principal Investments, LLC. The rights, preferences, privileges, qualifications, restrictions and limitations of the majority ownershares of Slide 3 AdvisorsSeries B Preferred Stock are set forth in the Series B Certificate. Under the Series B Certificate, the holders of the Series B Preferred Stock are entitled to receive, on each share of the Series B Preferred Stock on a quarterly basis, an amount equal to the dividend rate, as described in the following sentence, divided by four and multiplied by the then-applicable Liquidation Preference (as defined in the Series B Certificate) per share of the Series B Preferred Stock (collectively, the “Preferred Dividends”). The dividend rate is (1) 9.5% per annum for the period commencing on June 30, 2021 and ending on and including December 31, 2021, (2) 13% per annum for the year commencing on January 1, 2022 and ending on and including December 31, 2022; and (3) 14% per annum for the year commencing on January 1, 2023 and thereafter. The Preferred Dividends will be due in cash on January 1, April 1, July 1 and October 1 of each year (each, a “Series B Dividend Payment Date”). In the event Synchronoss not declare and pay a dividend in cash on any Series B Dividend Payment Date, the unpaid amount of the Preferred Dividend will be added to the Liquidation Preference.

On and after the fifth anniversary of the date of issuance, holders of shares of Series B. Preferred Stock will have the right to cause Synchronoss to redeem each share of Series B Preferred Stock for cash in an amount equal to the sum of the current liquidation preference and any accrued dividends. Each share of Series B Preferred Stock will also be redeemable at the timeoption of the acquisition.holder upon the occurrence of a “Fundamental Change” (as that term is defined in the Series B certificate) at (i) par in the case of a payment in cash or (ii) 1.5 times par in the case of a payment in shares of Common Stock (such shares being, “Registrable Securities”), subject to certain limitations on the amount of stock that could be issued to the holders of Series B Stock. In addition, the Company will be

60 Synchronoss Technologies

TABLE OF CONTENTS

permitted to redeem outstanding shares of the Series B Preferred Stock at any time for the sum of the then-applicable Liquidation Preference and the accrued but unpaid dividends. Pursuant to the Series B Certificate, Synchronoss will be required to use (i) the first $50 million of proceeds from certain transactions received by the Company to redeem for cash, shares of the Series B Preferred Stock, on a pro rata basis among each holder of Series B Preferred Stock and (ii) the next $25 million of proceeds from certain transactions received by the Company may be used by the Company to buy back shares of Common Stock, and to the extent, not used for such purpose by the Company, to redeem, for cash, shares of Series B Preferred Stock, on a pro rata basis among each holder of Series B Preferred Stock.

Synchronoss shall be required to obtain the prior written consent of the holders holding at least a majority of the outstanding shares of Series B Preferred Stock before taking certain actions, including (i) certain dividends, repayments and redemptions; (ii) any amendment to Synchronoss certificate of incorporation that adversely effects the rights, preferences, privileges or voting powers of the Series B Preferred Stock and (iii) issuances of stock ranking senior or equivalent to shares of Series B Preferred Stock (including additional shares of Series B Preferred Stock) in the priority of payment of dividends or in the distribution of assets upon any liquidation, dissolution or winding up of Synchronoss. Other than these engagements, there were no other transactionwith respect to the foregoing consent rights, the Series B Preferred Stock is a non-voting stock.

Investor Rights Agreement

Concurrently with the closing of the Preferred Transaction, Synchronoss and B. Riley Financial and B. Riley Principal Investments LLC entered into the Investor Rights Agreement. Under the terms of the Investor Rights Agreement, for so long as affiliates of B. Riley Financial beneficially own at least 10% of the outstanding shares of Common Stock (unless such equity threshold percentage is not met due to dilution from equity issuances), B. Riley Financial is entitled to nominate one Class II director (the “B. Riley Nominee”) to the Company’s board of directors, who shall be an employee of B. Riley Financial or seriesits affiliates and is approved by the Board, such approval not to be unreasonably withheld. For so long as affiliates of similar transactionsB. Riley Financial beneficially own 5% or more but less than 10% of the outstanding shares of Common Stock (unless such equity threshold percentage is not met due to which we were or are a partydilution from equity issuances), B. Riley Financial is entitled to certain board observer rights. In addition, in which the amount involved exceeded or exceeds $120,000 and in which any of our directors, executive officers,event that Synchronoss issues Registrable Securities to the holders of more than 5% of any class of our voting securities, or any member of the immediate family of any of the foregoing persons, had orSeries B Preferred Stock, such holders will have a direct or indirect material interest, other than compensation arrangements, which are described where required under "Executive Compensation"certain demand and "Director Compensation."piggy-back registration rights with respect to such Registrable Securities.

Section 16(a) Beneficial Ownership Reporting Compliance

We believe that, during the fiscal year ended December 31, 2015, our directors, NEOs, and greater than 10% stockholders complied with all applicable Section 16(a) filing requirements. In making these statements, we have relied upon a review of the copies of Section 16(a) reports furnished to us and the written representations of our directors, NEOs, and certain of our greater than 10% stockholders.

Other Matters

Our Board does not intend to bring any other business before the meeting, and so far as is known to the Board, no matters are to be brought before the meeting except as specified in the notice of the meeting. In addition to the scheduled items of business, the meeting may consider stockholder proposals whichthat are timely and comply with the provisions of our amended and restated bylaws (including proposals omitted from the Proxy Statement and form of Proxy pursuant to the proxy rules of the SEC) and matters relating to the conduct of the meeting. As to any other business that may properly come before the meeting, it is intended that proxies will be voted in respect thereof in accordance with the judgment of the persons voting such proxies.

Synchronoss Technologies 61

TABLE OF CONTENTS

Table of Contents

ELECTION OF DIRECTORS

The Board Recommends you vote FOR the election of director nominees

Our Board currently consists of six directors divided into three classes with staggered three-year terms.

Charles E. Hoffman has informed the Company that he will not stand for re-election at the Annual Meeting in order to devote his full time and efforts to his other commitments. Following the Annual Meeting, the size of our Board is expected to be decreased to five directors and there will be two Class II directors. Your proxy cannot be voted for a greater number of persons than the number of nominees named in this

proxy statement.Proxy Statement. Each director

who is nominated for election to our Board this year

as Class I directors, his

or her age as of April

6, 2016, his18, 2022, the position and office held with us and certain biographical information are set forth below.

Each directorThe two directors to be elected will hold office until the

20182025 Annual Meeting of Stockholders and until his

or her successor is elected, or until his

or her death, resignation or removal.

Each nominee listed below is currently a director of our Company who was previously elected by the stockholders. It is our policy to encourage nominees for director to attend the Annual Meeting.

Directors Four of our then serving directors, including Laurie L. Harris, attended our 2021 Annual Meeting of Stockholders.

Our directors are elected by a plurality of the votes cast at the Annual Meeting, meaning

that the

two nominees receiving the most

"For" voting“For” votes (among votes properly cast

in personat the Annual Meeting or by proxy) will be elected. An instruction to

"Withhold"“Withhold” authority to vote for a nominee will result in the nominee receiving fewer votes but will not count as a vote against the nominee. Abstentions and

"broker non-votes"“broker non-votes” (i.e., shares held by a broker or nominee that are represented at the meeting, but with respect to which

suchthe broker or nominee is not instructed to vote on a particular proposal and does not have discretionary voting power) will have no effect on the outcome of the election of a candidate for director.

Because the election of a director is not a matter on which a broker or other nominee is generally empowered to vote, broker non-votes are expected to exist in connection with this matter. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the

nomineesnominee named below. If

eitherany nominee becomes unavailable for election as a result of an unexpected occurrence, your shares will be voted for the election of a substitute nominee proposed by our current Board, if any. Each nominee for election has agreed to serve if elected. We have no reason to believe that

eitherany nominee will be unable to serve.

BOARD OF DIRECTOR QUALIFICATIONS.COMPOSITION

The following table includes the name, age, position, class and term expiration year for each of our directors and is current as of the date of this Proxy Statement.

| | Laurie Harris | | | 63 | | | Director | | | Class I | | | 2022 | |

| | Jeffrey Miller | | | 58 | | | President, CEO and Director | | | Class I | | | 2022 | |

| | Kristin S. Rinne | | | 67 | | | Director | | | Class II | | | 2023 | |

| | Martin F. Bernstein | | | 35 | | | Director | | | Class II | | | 2023 | |

| | Mohan Gyani | | | 70 | | | Director | | | Class III | | | 2024 | |

| | Stephen G. Waldis | | | 54 | | | Executive Chair of the Board | | | Class III | | | 2024 | |

62 Synchronoss Technologies

TABLE OF CONTENTS

DIRECTOR QUALIFICATIONS

The following paragraphs provide information as of the date of this

proxy statementProxy Statement about each member of our Board, including the nominees.

The information presented includes information each director has provided about his age, positions he currently holds, his business experience for at least the past five years, other publicly-held companies, if any, of which he currently serves as a director or has served as a director during the past five years, and involvement in certain legal or administrative proceedings, if applicable. In addition to the information presented below regarding each

director'sdirector’s experience and qualifications that lead our Board to the conclusion that he

or she should serve as a director of our Company in light of our business and structure, we also believe that all of our directors have a reputation for integrity and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment to our Company and our Board.

Table of Contents

DIRECTOR NOMINEES

The Board of Directors recommends that stockholders vote"FOR" each of “FOR” the nominees:

two nominees listed below:

| | | | | |

|

| LAURIE HARRIS

Director Since: 20002019 SynchronossCommittees:Age: 56

Founder

• Audit (Chair)

• Nominating/Corporate

Governance |

|

| Laurie L. Harris James M. McCormick

James M. McCormickserved as global engagement audit partner at PricewaterhouseCoopers LLP (PwC), a global and top-tier assurance, tax and advisory firm, for 25 years before retiring in 2018. Ms. Harris currently serves as a director of IWG, plc, Hagerty, Inc. and on several private company boards. Ms. Harris received a bachelor of science degree in business administration from the University of Southern California and is a founder of Synchronoss, has been a member oflicensed CPA in New York and California. Our Board believes Ms. Harris’ qualifications to sit on our Board since our inception in 2000include her extensive financial experience and her more than three decades of experience advising large public companies, private equity backed entities and Fortune 100 organizations.

| |

| |

JEFFREY G. MILLER

Director Since: 2021

Synchronoss

Committees:

• Business Development | | | Jeffrey G. Miller has served as our Treasurer from September 2000 until December 2001. Mr. McCormick is founderPresident, Chief Executive Officer and a Director since March 2021, after holding the position of interim President and Chief Executive Officer since September 2020. Mr. Miller joined Synchronoss as Chief Commercial Officer in October 2018. Mr. Miller previously served as President of Vertek Corporation.IDEAL Industries Technology Group from December 2017 to October 2018. Prior to founding VertekIDEAL, Mr. Miller held several senior sales and operations positions at Motorola during a 16-year tenure, most recently as Corporate Vice President and General Manager of Operations in 1988,North America for Motorola Mobility, LLC. Mr. McCormick was a member of the Technical Staff at AT&T Bell Laboratories. Mr. McCormickMiller received a Bachelor of Science degree in computer sciencebusiness from theMiami University of VermontOhio and a master of sciencemaster’s degree in computer scienceBusiness Administration from the University of California — Berkeley.The Ohio State University. Our Board believes Mr. McCormick'sMiller’s qualifications to sit on our Board include his over 25 yearsbroad experience in the consulting, telecommunicationssoftware and services business,industry and his experience with our Company. | |

Synchronoss Technologies 63

TABLE OF CONTENTS

Continuing Directors — Term Ending in 2023

| |

KRISTIN S RINNE

Director Since: 2018

Synchronoss

Committees:

• Audit

• Nominating/Corporate

Governance (Chair) • Compensation

• Business Development | | | Kristin S. Rinne held various senior positions at AT&T, including heading the company’s networks technologies organization, until she retired in 2014. Ms. Rinne brought early leadership in deploying GSM technology in the United States, setting the stage for the success of the 3GPP family of technologies. Ms. Rinne formerly held the positions of vice president of technology strategy for SBC Wireless and managing director of operations at Southwestern Bell Mobile Services. Her contributions to the industry also include serving as chairperson of the Board of Governors at 3G Americas, LLC, and the Alliance for Telecommunications Industry Solutions (ATIS). Ms. Rinne is a “Women in Technology Hall-of-Famer”, as well as being onea member of the “Wireless Hall of Fame,” and was named among Fierce Wireless’ “Top 10 Most Influential Women in Wireless” list from 2011 through 2014. Ms. Rinne holds a bachelor’s degree from Washburn University. Our Board believes Ms. Rinne’s qualifications to sit on our founders.Board include her extensive experience in the telecommunications industry. | |

| | | | | |

| |

MARTIN F. BERNSTEIN

Director Since: 20072021

Age: 67

• Nominating/Corporate Compensation

Governance

• Business Development | | | Martin F. Bernstein Donnie M. Moore

Donnie M. Moorehas served on the Board since July 2021. Mr. Bernstein brings extensive experience working with management teams and boards on capital allocation strategies, governance, financing and operational turnarounds. He currently serves as the Head of Private Investments with B. Riley Principal Investments and is responsible for sourcing, underwriting and managing company investments in addition to leading distribution to the firm’s syndication partners. He has led numerous investments across technology, transportation, automotive, aerospace, manufacturing, power, infrastructure and other sectors. Prior to joining B. Riley in March 2021, Mr. Bernstein was Senior Vice President, Financewith Anchorage Capital and Administrationled investments across capital structures, including public equities, private equity, performing credit, bank debt and Chief Financial Officer for Cognos Incorporated, a publicly-held company providing business intelligencedistressed debt and performance management solutions, from 1989 until his retirement in 2001. From 1986 to 1989, Mr. Moore was Vice President, Finance and Chief Financial Officer of Cognos. Before joining Cognos, Mr. Moore held various positions at the Burroughs Corporation from 1973 to 1986, including Corporate Director, Plans and Analysis. Mr. Moore holds a Bachelor of Science degree in engineeringrestructuring situations from the Universityfirm’s New York and London offices. He previously worked as an analyst at Bocage Capital and was on the investment team for the endowment at Howard Hughes Medical Institute. Mr. Bernstein currently serves on the board of Oklahoma and a masternominees for Fondul Proprietatea. Mr. Bernstein earned an AB in business administration degreehistory from the University of Houston.Dartmouth College. Our Board believes Mr. Moore'sBernstein’s qualifications to sit on our Board include his extensive experience in the software industryworking with management teams and his financial expertise.boards on capital allocation strategies, governance, financing and operational turnarounds.

| |

64 Synchronoss Technologies

Table of ContentsTABLE OF CONTENTS

Continuing Director — Term Ending in 2017

| | | | |

| |

Director Since: 2004

Age: 59

Synchronoss Committees:

•

Audit

•

Compensation

•

Business Development

| | Thomas J. Hopkins

Thomas J. Hopkins is a Managing Director of Colchester Capital, LLC, an investment firm. Prior to Colchester Capital, Mr. Hopkins was involved in investment banking, principally at Deutsche Bank (and its predecessor Alex, Brown & Sons), Goldman, Sachs & Co. and Bear Stearns. He began his investment banking career at Drexel Burnham Lambert. Prior to investment banking, Mr. Hopkins was a lawyer for several years. Mr. Hopkins received a Bachelor of Arts degree from Dartmouth College, a juris doctorate from Villanova University School of Law and a master in business administration degree from the Wharton School at the University of Pennsylvania. Our Board believes Mr. Hopkins' qualifications to sit on our Board include his extensive financial expertise and his years of experience providing strategic advisory services to complex organizations.

|

Continuing Directors — Term Ending in

20182024

| | | | | |

| |

Director Since: 2005

Age: 67

Synchronoss Committees:STEPHEN G. WALDIS

•

Audit•

Compensation

•

Business Development

•

Nominating/Corporate

Governance

| | William J. Cadogan

William J. Cadogan served as a Senior Managing Director with Vesbridge Partners, LLC, formerly St. Paul Venture Capital, a venture capital firm from 2001 until 2006. Mr. Cadogan served asFounder and Former Chief Executive Officer and Chairman of the board of directors of Mahi Networks, Inc., a leading supplier of multi-service optical transport and switching solutions, from November 2004 until its merger with Meriton Networks in October 2005. Prior to joining St. Paul Venture Capital in 2001, Mr. Cadogan was Chairman and Chief

Executive Officer of ADC, Inc., a leading global supplier of telecommunications infrastructure products and services. Mr. Cadogan received a Bachelor of Arts degree in electrical engineering from Northeastern University and a master in business administration degree from the Wharton School at the University of Pennsylvania. Our Board believes Mr. Cadogan's qualifications to sit on our Board include his experience as a CEO leading complex global organizations, combined with his operational and corporate governance expertise. |

Table of Contents

| | | | |

| |

Founder

ChairmanChair of the Board

Chief Executive Officer

Director Since: 20012000

Age: 48

| | | Stephen G. Waldis

Stephen G. Waldis has served as our Chairman, FounderExecutive Chair since January 2017, having served as Chair of the Board since 2001, Chief Executive Officer from 2000 until January 2017 and CEO andas a Directordirector since founding Synchronoss in 2000. From 2000 until 2011, Mr. Waldis also served as President. From 1994 to 2000, Mr. Waldis served as Chief Operating Officer at Vertek Corporation, a privately held professional services company serving the telecommunications industry. From 1992 to 1994, Mr. Waldis served as Vice President of Sales and Marketing of Logical Design Solutions, a provider of telecom and interactive solutions. From 1989 to 1992, Mr. Waldis worked in various technical and product management roles at AT&T. Mr. Waldis received a Bachelor of Arts degree in corporate communications from Seton Hall University. Our Board believes Mr. Waldis'Waldis’ qualifications to sit on our Board include his extensive experience in the software and services industry and previously serving as our Chief Executive Officer and one of our founders.

| |

Incumbent Director — Not Standing for Election

| | | | | |

| |

MOHAN GYANI

Director Since: 20062019

Age: 67

• Compensation

(Chair) • Nominating/Corporate

Governance Administration

Business Development | | | Mohan S. Gyani Charles E. Hoffman

Charles E. Hoffman has beenheld several executive positions in the Dean of the College of Business of the University of Missouri-St. Louis since September 2013. From 2001telecommunications industry including at AT&T Wireless from 2000 until he retired in 2008, Mr. Hoffman was2003 as President and Chief Executive Officer of Covad Communications Group, Inc.AT&T Wireless Mobility Services. Prior to 2001,AT&T, Mr. HoffmanGyani was Executive Vice President and Chief Executive OfficerCFO of Rogers AT&T. PriorAirTouch from 1994 to his time with Rogers,1999. Mr. HoffmanGyani has served as President, Northeast Region, for Sprint PCS. Preceding his time with Sprint PCS,on numerous public and private company boards and is currently a member of the Board of Directors of Digital Turbine. Mr. Hoffman spent 16 years at SBC Communications in various senior management positions, including Managing Director-Wireless for SBC International. Mr. HoffmanGyani received a Bachelor of Sciencebachelor’s degree and a mastermaster’s in business administration degree from San Francisco State University. Our Board believes Mr. Gyani’s qualifications to sit on our Board include his extensive experience in the University of Missouri.telecom and wireless industries and in senior financial positions.

| |

Synchronoss Technologies 65

TABLE OF CONTENTS

Table of Contents

RATIFICATION OF THE APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board has appointed Ernst & Young LLP, independent registered public accounting firm, as the

Company'sCompany’s independent registered public accounting firm for the fiscal year ending December 31,

20162022 and has further directed that management submit the appointment of the independent registered public accounting firm for ratification by the stockholders at the Annual Meeting. Ernst & Young LLP has audited the

Company'sCompany’s financial statements since its formation in 2000. Representatives of Ernst & Young LLP are expected to be present at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither the

Company'sCompany’s amended and restated by-laws nor other governing documents or law require stockholder ratification of the appointment of Ernst & Young LLP as the

Company'sCompany’s independent registered public accounting firm. However, the Board is submitting the appointment of Ernst & Young LLP to the stockholders for ratification as a matter of good corporate practice. If the stockholders fail to ratify the appointment, the Audit Committee of the Board will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee of the Board in its discretion may direct the appointment of different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders.

To ratify the selection by the Audit Committee of Ernst & Young LLP, as the independent registered public accounting firm of the Company for its fiscal year ended December 31,

2016,2022, the Company must receive a

"For"“For” vote from the majority of all the outstanding shares that are present

in personat the Annual Meeting or represented by proxy and cast either affirmatively or negatively at the Annual Meeting. Abstentions and broker non-votes will not be counted

"For"“For” or

"Against"“Against” the proposal and will have no effect on the proposal. Because this

proposal is a

routine matter,

on which a broker or other nominee

ismay generally

empowered to vote

broker non-votes are not expected to exist in connection withon this

matter.proposal.

INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM'SFIRM’S FEES

The following table represents aggregate fees billed to the Company for fiscal years ended December 31,

20152021 and December 31,

20142020 by Ernst & Young LLP, the

Company'sCompany’s principal accountant.

| | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | |

| Fiscal Year Ended